Elan Reinsurance

Services

Protecting Your Business with

Comprehensive Stop-Loss Coverage

Elan Reinsurance Services (ERS) is a new Florida-authorized insurance company and an integral part of the Elan group, trusted in employee benefits since 2012. ERS offers innovative stop-loss solutions that delivers lasting protection for businesses and employees.

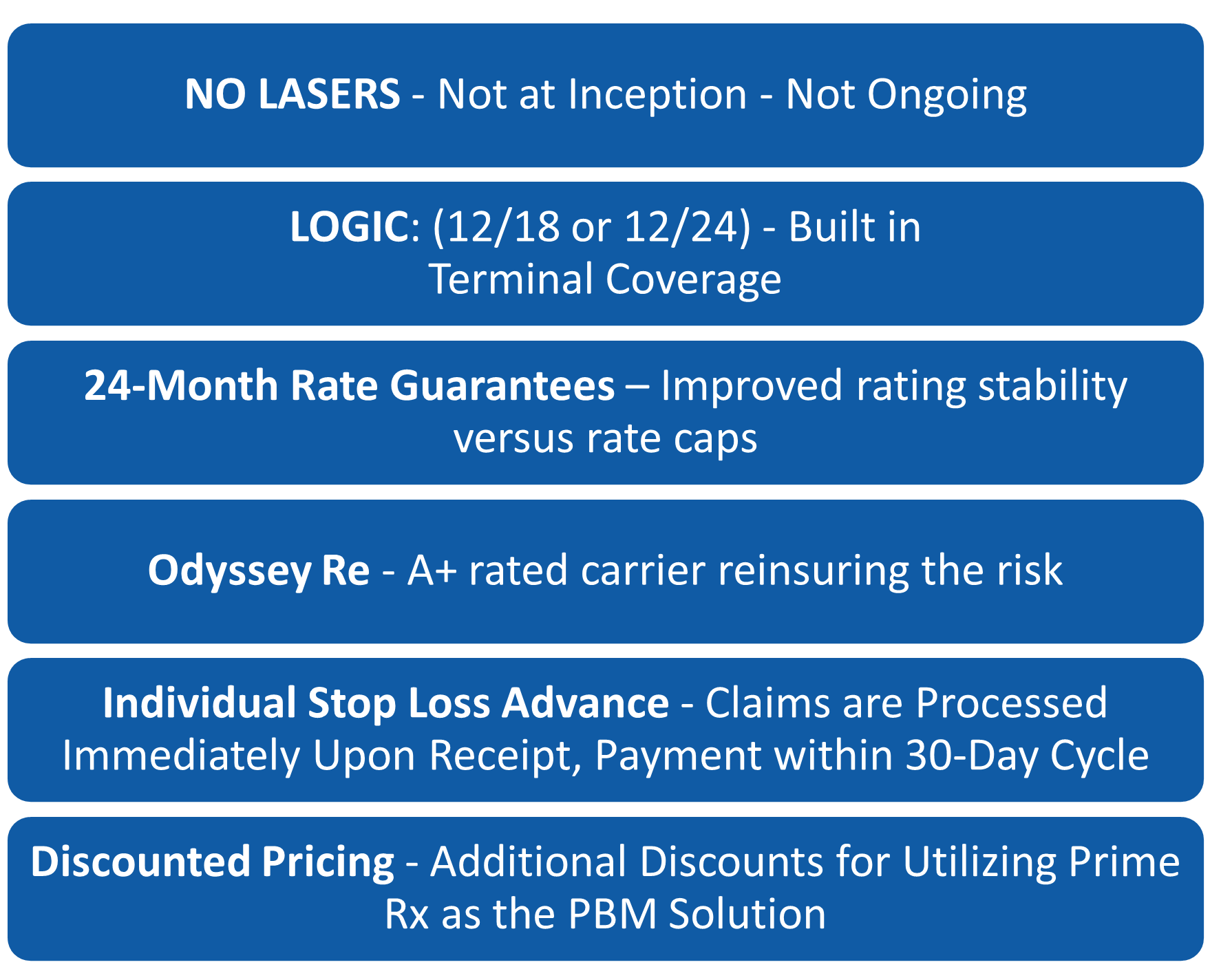

✅ Backed by Strength – Partnered with Odyssey Re, an AM Best A+ rated carrier, providing unmatched financial security and reliability.

✅ Driving Innovation, Together – We leverage innovation to enhance our services and stay ahead of evolving market needs. By partnering with industry leaders and harnessing AI technology, we deliver forward-thinking solutions that set ERS apart.

✅ Built for Flexibility – ERS provides stop-loss coverage and administration services for level-funded and self-funded plans, supporting robust benefit programs that give businesses and employees lasting peace of mind.

Why Choose ERS Stop-Loss Coverage?

✅ Comprehensive Protection: Tailored coverage designed around your company’s unique needs.

✅ Industry Expertise: Over a decade of company-wide expertise in self-funded plan administration and stop-loss coverage.

✅ Flexible Options: Customizable specific and aggregate thresholds to fit your business.

✅ Superior Claims Support: Dedicated expert team delivering seamless claims management.

Customizable Stop Loss Options

Our Stop-Loss Plan Features

✅Adjustable specific and aggregate deductible limits

✅Multiple reimbursement options

✅Competitive premiums

✅Flexible contract terms: 12/24, 12/18, 12/15, 12/12

Quick Proposal Fulfillment

✅AI-driven underwriting and modeling tools for rapid risk evaluation

✅Strategic partnerships with CAS, Odyssey RE, and US-RX Care streamline resources

✅Proposals delivered in less than 72 hours

Prompt Claims Reimbursement

✅95% of claims submitted for reimbursement are processed within 10 business days

Our Motto: “Winning by Doing What is Right!”

At ERS, we’re committed to your success—not just today, but for the long term. Achieving lasting results requires a partner dedicated to every step of the journey. That’s why we go beyond helping you meet your goals—we help you exceed them, securing a stronger future.

Our team of expert Underwriters utilize:

✅ Robust models and market data: Over 100-million-member months analyzed to set baselines, trend, and pricing models for groups under and over 500 employees, and over 500 employees.

✅ 70% target MLR: Compliant with FLOIR’s minimum loss ratio formula.

✅ Independent and Expert Actuarial Reviews – All models and baselines validated by Axene Health Partners.