A Better Way to Group Health Plans

Traditional Healthcare is Broken

For decades, businesses have struggled with exploding healthcare costs and limited solutions, often forcing them to pass these costs on to their employees. Employers are left feeling stuck, meanwhile major insurers stock prices have risen over 1500% since 2012.

Rising Costs

On average, employers are seeing healthcare costs rise 20-30% a year, increasing premiums for employers and employees. This forces employers to pass costs on to the employees.

Barriers to Getting Care

Members often have to be their own advocates and navigate the system themselves, coordinating authorizations or being their own technical support.

Lack of Transparency

Hidden fees, complex pricing structures, and unclear reimbursement rates often lead to unexpected expenses and limited options for care.

Burden of Education

Explaining benefits to employees is a never-ending endeavor that employers are often left to figure out for themselves.

Why Elan over Traditional Health Insurance?

Employers are choosing Elan because we created health plans that put the interests of the employee first, and then everyone else. Our approach is patient centric, cost intelligent, and transparent, here’s how:

✅Aligned Incentives: We’ve seen countless examples where healthcare suppliers make more money when costs go up. Instead, we carefully selected partners who are incentivized when patient outcomes improve, and the cost of healthcare goes down. Additionally, each of our suppliers must sign a fiduciary clause, which means that they will act solely in the best interests of the members they serve (you) and not their own profit motives.

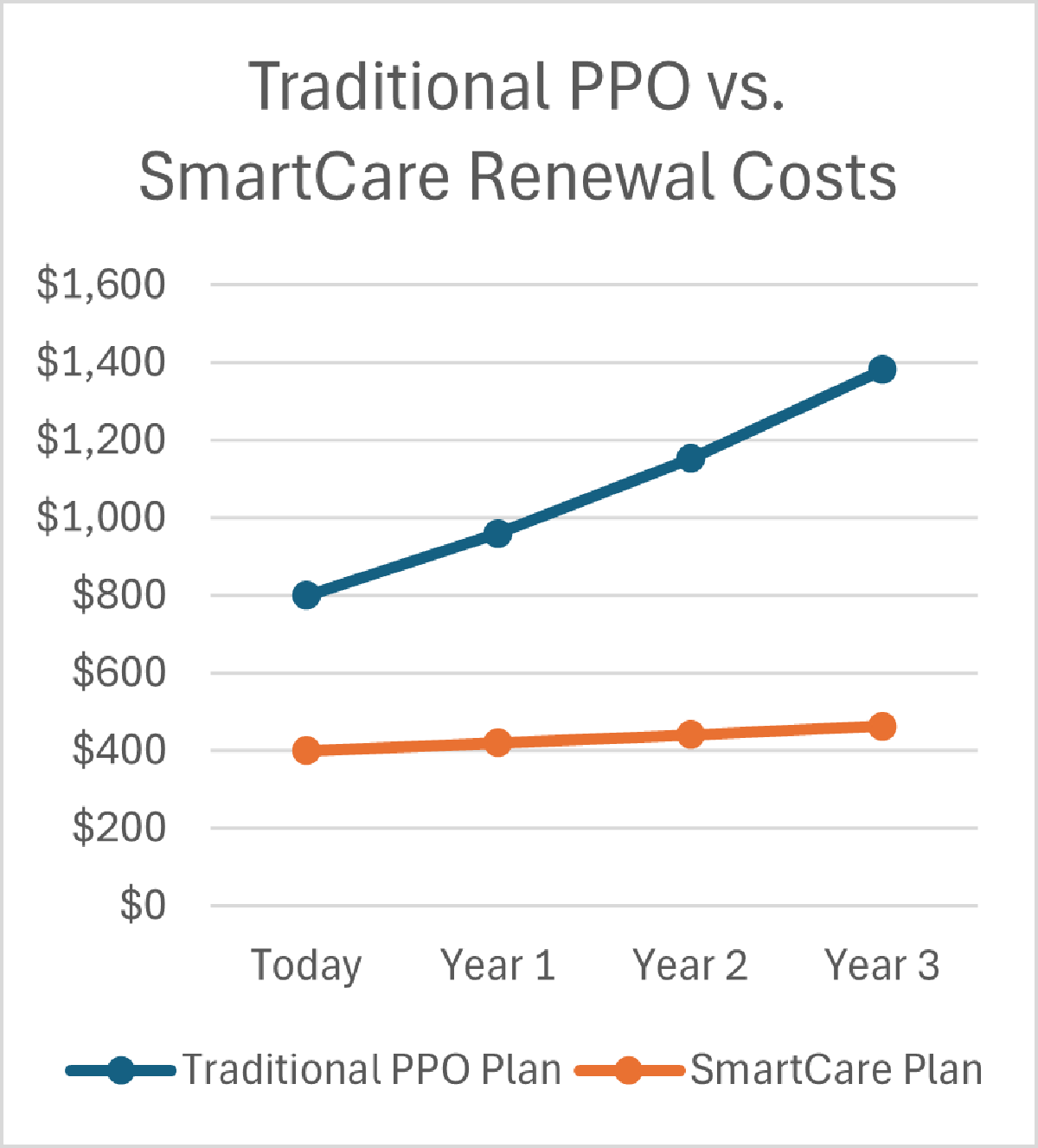

✅Lower Costs and Financial Transparency: Employers can expect to save 20-25% first year when they implement our SmartCare plan and tie their contributions to it. The savings jump to 35% on year 2, and 45% on year 3. Ask us about our case studies and examples. You also get access to claims data, quarterly performance reporting, and case management metrics.

✅Power of Choice: Your workforce has diverse needs, and your benefit offering should reflect that. With Elan, you can offer different healthcare delivery models, not just varying deductible levels. The result? Happier employees and budget stability – more on that below.

✅Reliability: Elan is backed by an A+ reinsurance partner, and we have various financial and actuarial firms validating our financials, pricing, and risk exposure for our customer’s long-term benefit.

The Elan Difference

We provide employers with a comprehensive solution for managing healthcare costs while prioritizing quality.

How We Deliver Savings to You

We help you achieve meaningful savings through long-term cost control and smart management of key cost drivers.

Long-Term Cost Control

✅Our clients typically see average annual increases of just 5–7%, compared to the industry norm of 15–20%.

✅We also offer the ability to lock in rates for up to two years—ask us about our rate guarantee options.

Controlling the Drivers of Cost

✅High-performance network infrastructure.

✅De-conflicted clinical management for Pharmacy rebate and markup protection.

✅ Guided Care that brings genuine clinical and experiential value to members, while protecting employers’ bottom line.

Pharmacy Program: Taking the Fox Out of the Henhouse

We’re redefining pharmacy benefits with a patient-first approach and a commitment to cost savings. By partnering with trusted industry leaders, we eliminate hidden markups and rebate schemes that drive up prices and expose employers to ERISA liability.

Our collaboration with US-Rx Care, an independent third-party expert in specialty medication management, ensures clinical integrity and transparency. Meanwhile, our contracts with US-Rx care include strict fiduciary and transparency provisions—holding every partner accountable. This is just one of the many ways we deliver smarter, safer, and more ethical pharmacy solutions.

Our Pharmacy Solutions:

✅US-Rx Care – 24/7 support and a robust pharmacy network for superior member experience. Plus, Specialty and prior authorization solutions ensuring compliance and cost control

✅ScriptSourcing – $0 copay for 2000+ brand-name maintenance medications plus options to save on some specialty medications.

Guided Care: Value to Members, while Protecting Bottom Line.

Beyond the core savings and structure above, our unique Guided Care program is a differentiator—bringing genuine clinical and experiential value to members, while protecting employers’ bottom line.

🔍 What is Guided Care?

Guided Care means every member has access to proactive, nurse-led care coordination and coaching. Rather than simply handing a benefits card, we empower members to make smarter decisions, avoid low-value care, and stay on healthier pathways—resulting in better outcomes and lower cost.

💡 Benefits for Employers

-

- Reduced Cost Drivers: By intervening early, guiding members to high-value providers, and avoiding unnecessary or duplicate services, Guided Care helps drive down the largest cost trends.

-

- Better Budget Predictability: When members are actively guided, utilization becomes less erratic—helping you control annual increases (typically 5-7%, vs industry 15-30%) under our model.

-

- Improved Workforce Health & Engagement: Members who feel supported more, adhere to treatment, and stay healthier—reducing absenteeism and boosting satisfaction.

-

- Fiduciary Alignment: Guided Care aligns clinical oversight with financial oversight—no conflict between what’s good for the member and what’s economical.

✅ Benefits for Members

-

- Personalized Support: A skilled nurse or care advocate becomes their partner—helping with appointments, explaining options, coordinating specialists and surgeries, even navigating networks.

-

- Better Outcomes, Lower Stress: Members don’t have to figure out the system alone. Guided Care reduces confusion, improves compliance, and leads to better care experiences.

-

- Transparent, High-Value Care: Guided Care identifies the best-value providers, helps avoid surprise bills, and ensures care happens in the most efficient setting possible.

-

- Holistic Health Focus: Beyond treating illness, Guided Care supports preventive care, chronic disease management, and member engagement over time.

The real proof comes from members.

Here’s what a Guided Care member had to say: